**Why More US Users Are Talking About the “Secret PayPal Hack That Lets You Pay in Just Four Clicks”** In a digital landscape where convenience drives online behavior, subtle but powerful shortcuts are reshaping how Americans manage payments. One such trend gaining quiet momentum online is the idea of paying with PayPal in just four clicks—so discreet, even Xia% considers it a “secret” way to simplify everyday transactions. While no official “hack” exists, growing discussions reflect real demand for seamless, instant payment experiences. This article explores why this phrase resonates across the U.S., how similar workflows actually function, and what users should realistically expect. **Social and economic shifts are fueling the curiosity** Recent trends show rising frustration with lengthy payment processes—whether during online shopping, freelance income receipt, or mobile money transfers. With easier access to digital wallets and employer-adopted payment tools, Americans increasingly expect quick, frictionless transactions. The “four-click” benchmark emerges as a metaphor for speed, especially among younger users and gig workers who value instant access and minimal steps. Even subtle shifts in digital culture—like demand for faster checkout—are setting the stage for such convenient habits. **How do these “four-click” payments actually work?** While not a universal feature, select payment platforms and apps leverage automation, API integrations, and pre-authorized transactions to reduce steps. For instance, savvy users often combine saved payment methods with trusted apps that sync automatically. Some mobile wallets support one-click trials after verification, and employer payroll portals use streamlined digital flows—partial solutions that contribute to the perception of rapid payment. This “four-click” ideal reflects a blend of existing automation and smart UX design aimed at reducing friction without compromising security.

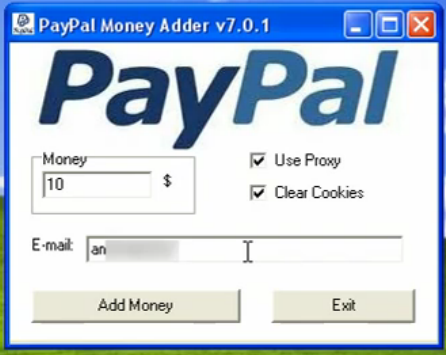

- **Is it real, or just a rumor?** There’s no single “hack” granting instant payment. The phrase reflects realistic progress toward faster processing enabled by updated payment APIs and integrated financial tools—not a conspiracy or flaw. - **How do I start?** Secure apps and platforms integrate PayPal and similar services through bookmarked or saved payment flows. Once linked, authorized transactions can require minimal steps during checkout. - **Will this work across accounts?** Compatibility depends on platform setup. Always verify permissions and consent to protect account security. - **Is this safe?** Legitimate use requires authentication, encryption, and trusted interfaces. Avoid third-party tools promising “hacks”—they often compromise safety. **Opportunities and realistic expectations** This trend highlights broader digital adoption: Americans seek control without complexity. The “four-click” ideal pushes service providers to refine UX while maintaining transparency. Users benefit when interfaces are intuitive but must stay alert to security best practices. PayPal and financial apps leveraging streamlined flows offer convenience—but no shortcut promises instant results without verification or context. **Myths that mislead, and what to trust** - *Myth: PayPal lets you bypass every step completely.* Reality: Some apps allow one-click after setup, not 100% frictionless. - *Myth: You can use this method for unlimited or unrestricted spending.* Reality: Policies and linked accounts still enforce limits and monitoring. - *Myth: It works the same everywhere.* Reality: Implementation varies by app, country, and account type. Instead, focus on secure patterns: pre-authorized tools, verified linked methods, and clear user controls. **Who benefits from faster payment flows like this?** From freelancers managing cash flow, small business owners simplifying invoicing, to students receiving income quickly—this convenience bridges gaps in digital trust and speed. Anyone prioritizing quick access, transparency, and automation in financial interactions stands to gain, as long as choices align with real security standards. **Explore with awareness—master your digital money flow** The “secret” here isn’t a hidden trick but mindful use of evolving tools. Stay informed about legitimate integrations, verify sources, and choose platforms that combine simplicity with security. The future of payments leans toward speed, transparency, and ease—whether by four clicks or smarter defaults. Stay curious, stay informed, and manage your digital funds with confidence.

**Explore with awareness—master your digital money flow** The “secret” here isn’t a hidden trick but mindful use of evolving tools. Stay informed about legitimate integrations, verify sources, and choose platforms that combine simplicity with security. The future of payments leans toward speed, transparency, and ease—whether by four clicks or smarter defaults. Stay curious, stay informed, and manage your digital funds with confidence.

This Classic Film Will Make You Question Everything—Unforgettable Climax

The Farm-to-Meter Secret No One Talks About—Now Revealed

Your Grocery List Just Got Scary—Publix Prices So High Publishers Hid Them